Welcome to

Ark Capital LLC

Our Venture Capital practice focuses on the commercializing of various business models originated by our internal team and strategic relationships. In rare cases, we identify distressed and restructuring opportunities in which we can make profitable thru our network, geographic capabilities, and experiences.

Our Team's Recent Focus

is in firms exploring International Expansion:High Tech

The future of technology, from AI to quantum computing.

Software

Support software startups that solve real-world problems, from cloud to mobile.

Entertainment

Entertainment ventures that create engaging content, from gaming to streaming.

FinTech

Innovations that transform the financial industry, from blockchain to robo-advisors.

Manufacturing

Enterprises that optimize production, from green tech to 3D nantech printing.

High Growth Cycle Operations

Operations that scale rapidly, from logistics to SaaS marketplaces.

Our Venture Capital Portfolio

- BlockChain

- Intelligence Platforms

- Retail

- Textiles

- Construction - MultiUnit, Commerical & Residential

- Plastics Manufacturing

- Software - SaaS - Travel - Hospitality

- Artifical Intelligence

- Automotive

- Industrial Manufacturing

- Software - Enterprise, Financial Services & Specialized Niches

- Energy Transportation

- Gaming

- Telecommunications

- Real Estate

- Cosmetics

- Food & Beverage

- Oil & Gas

Our firm's experience allows us the advantage to consider a broad variety of Venture Development Opportunities. The investment agnostic approach in considering New Ventures fixates on opportunities that would be enhanced thru our extensive network of strategic relationships and access to expand visions with financial efficiencies and market knowledge.

Our Venture Capital Cooperative Engagement

Services Includes:

- Capital Sourcing for GP Venture Partners & Private Equity Funds seeking Seed & Growth funds.

- Venture Partner Firms seeking Specific Strategic Capital, M&A Sourcing, Partial Exit or Liquidity.

- Internal Network Private Placement Memorandum Fund Raising.

- Strategic Capital Sourcing for Private Equity & Venture Capital Firms.

- Sourcing Specific Target Commerical Interests for Investment Funding Entities & Enterprises.

- International Venture Capital Development for Industrial Groups, Venture Capital Firms, & Private High Net Worth Individuals.

Our Cooperative Venture Capital Services focuses on working with our current relationships and firms in the financial services industry whose mission and mandates align with our traditional practice. The nature of entities referenced above value the synergies created by our international exposure and closed network of commercial partner relationships. Ark Capital welcomes requests of potential engagement and is encouraged and honored to be considered by its peers. Our team is vested in aiding our new and previous industry related associations in accomplishing their Goals and Vision even when we quickly identify that we are unable to bring the highest value. In such cases, we are always pleased to connect, recommend, or provide guidance.

Venture Capital Client Engagement Services for Start-Ups & High Growth:

- Developing Alternative Listing Options for firms with multiple shareholders seeking funding for various purposes such as: Exit, Visibility, Growth, and/or the creation of Liquidity and Capital Base Expansion.

- Private Placement Memorandum Documentation Creation & Advisory.

- Growth Capital Sourcing for surgical expansion into New Markets, Products, Services or Pre-Defined Target Acquisition.

- Crowdfunding Document Creation.

- Initial Public Offering Document Creation and Advisory.

- Alternative Listing Document Development & Execution.

The Venture Capital Client Engagement Service is our passion! Ark Capital's core foundation was born to assist founders, executive management teams and shareholders in maximizing value and potential.

Our team is at its best when:

- expanding a Ventures Value Proposition in New Market Geographies to capture additional market share,

- guiding organizations on how to effectively engage all parties involved in raising capital for a variety of circumstances,

- controlling costs of Professional Services Providers by magnitudes, and

- executing complex value creating strategies.

Our team is experienced in managing costly professional fees, generating creative options to add value and is knowledgeable on how best to utilize scarce resources. The ultimate goal of our team is to amplify capital spent, enterprise opportunities, and develop reinforced core strategies to result in quantifiable results against our associated fees. Please feel free to contact our team for actual engagement achievements.

Our Clients

History

Engagements

Relationships

.png)

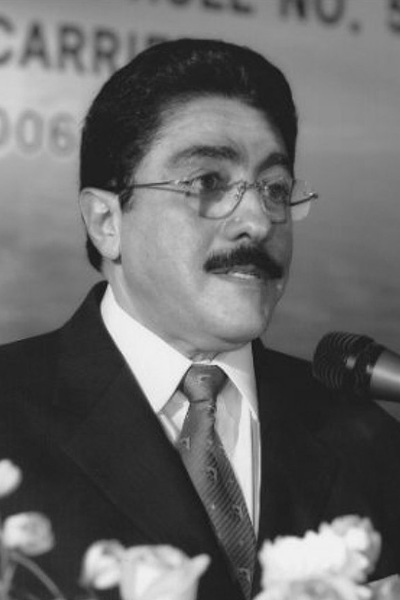

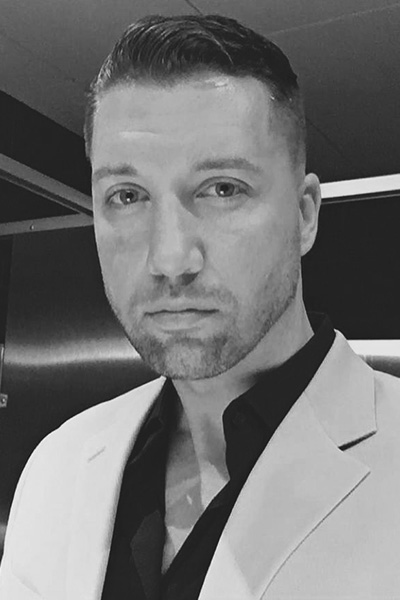

Our Team

Value Created

Years Experience

Revenue Generated

Value Realized

Leadership